Engineering Workstation Market Bulking Up

Virtual roundtable gathers insights on the state-of-the-workstation market.

The Lenovo ThinkStation P360 Ultra is a new entrant in the small form factor (SFF) workstation market. It uses NVIDIA GPUs designed for mobile workstations. Image courtesy of Lenovo.

Latest News

December 16, 2022

For the past couple of years, the engineering workstation market was more about form factor than computational features. Sales made a sharp turn into mobile computing during the pandemic. This year, the balance has started to shift back toward desktop models being the larger part of total sales.

Now that work from home is retreating, engineering companies are looking to refresh their computers with an eye to increased performance.

Overall unit volume was up 22% year over year for the second quarter of 2022, with fixed workstations rising as a percentage of the total, according to market research firm Jon Peddie Research and senior analyst Alex Herrera. That tide is lifting all boats, so to speak. Mobile workstations sales are still growing, up 26% as of the second quarter.

Intel’s new Alder Lake generation of CPU technology has also stirred up the marketplace.

“The big change is a hybrid approach that allows a single processor to run two separate types of cores—P-Cores for Performance and E-Cores for efficiency,” notes Herrera. “A high-performance deskside workstation can install an Alder Lake CPU that offers more P-Cores, while a mobile workstation can use a CPU that offers more E-Cores.”

“We’re actually seeing a little more of a resurgence in full tower builds, compared to a few years ago,” says Josh Covington, managing director of sales and marketing for Velocity Micro. “Graphics cards are getting bigger and more power hungry with each generation, making it virtually impossible to properly cool a professional workstation in a small form factor.”

For insights on the present and near-term state of the engineering workstation market, we took a lesson from the work-from-home era and convened a virtual roundtable. The following is a lightly edited version of the original comments.

Digital Engineering: Size and mobility defined workstation sales during the pandemic. What are engineering teams buying now, and what do you expect them to buy in the next year or so?

Josh Covington, Velocity Micro: We are finding customers care more about power and reliability than footprint. Additionally, the newer multicore processors like AMD’s Threadripper PRO are designed to run at higher thermal design point and higher overall temperatures, making thermal management all the more important—something that full towers are almost always better at.

Allen Bourgoyne, director of product marketing, professional solutions at NVIDIA: Small form-factor workstations continue to grow in popularity, and there’s now more availability of higher performance, small form-factor systems, with more powerful CPUs and GPUs that make them suitable solutions for a wider range of customers. I would not say that small form-factor workstations are displacing other form factors—instead, they’re giving customers more choice, especially in space-constrained locations such as home offices, factory floors or job sites, where the need for powerful systems with minimal footprint is important.

NVIDIA RTX technology for real-time graphics is now available for all workstation form factors. Image courtesy of NVIDIA.

Eric Grundstrom, director, field applications engineering and business development, Supermicro: New information technology extended (ITX) and other small footprint form factors are being introduced due to the adoption of NVIDIA A2000 and other more compact GPUs. These types of workstations are well suited to individual CAD/CAE user needs.

Rob Herman, vice president and general manager, Lenovo workstation and client AI group: We expect to see a shift back to desktop workstations in the future as workers return to the office, bringing balance back between the mobile and desktop mix. As hybrid and remote work become more prevalent, the need for smaller desktop form factors in desktops will grow. Lenovo recently introduced a product that we strongly believe will fit these user requirements, the ThinkStation P360 Ultra. At 3.9 liters with graphics scaling up to an NVIDIA A5000M and up to Intel Core K class CPUs, we’re delivering more performance than any of the larger small form factor products in the industry.

DE: There are four workstation market segments: Mobile, Entry Level, Intermediate and High. Are there changes in how customers buy in each segment?

Rodney Mach, president, TotalCAE: Today’s supercomputer is tomorrow’s workstation. As workstations get more powerful, engineers expand the requirements of the simulation to take up the new available horsepower to improve their products.

Covington (Velocity Micro): We service all these segments. We’re seeing our average order value continue to increase as our workstation customers embrace the benefits of investing in higher performing hardware. After all, better performance often means better productivity for these customers. We have seen some erosion of the entry-level customer recently. I’d suspect this is due to specific competitors continuing to get aggressive on pricing to win over the price-driven customer.

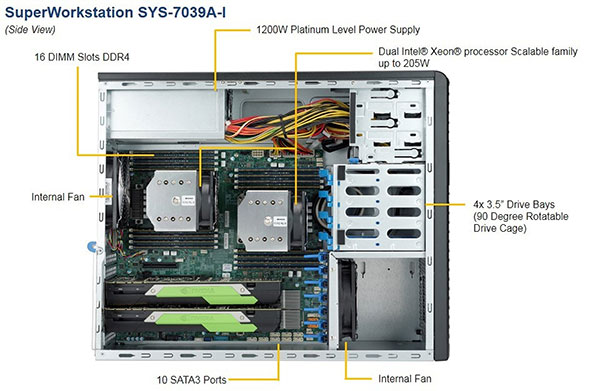

Grundstrom (Supermicro): We continue to see demand for the Intermediate and High categories. The demand for these types of workstations is high, as new workloads can be run on the latest generation of CPUs and GPUs within a workstation.

Primarily known for its HPC clusters, Supermicro also sells a line of top performance workstations. Click here for full-size version. Image courtesy of Supermicro.

Herman (Lenovo): There’s definitely been a shift towards mobile workstations. Before the pandemic, mobile workstations made up approximately 40% of the workstation market. Today, that number has grown to roughly 60%. In the desktop workstation market, on the other hand, we have seen a gradual shift to entry-level machines. This is primarily due to a progression toward platforms that accommodate higher performing GPUs with higher spec’d power supplies. In addition, core processors have become more powerful with a larger number of cores available.

DE: What is the biggest change in workstation configuration in recent years?

Bourgoyne (NVIDIA): With respect to NVIDIA professional visualization products, we have seen growing adoption of RTX technology. As customers continue to include AI-augmented applications, photorealistic rendering and simulation as part of their processes, they need RTX-enabled solutions to power these modern workflows.

Covington (Velocity Micro): With Intel and AMD engaged in real competition for the first time in 10-plus years, we’ve seen core counts, frequencies and cache all consistently increasing. It’s a pretty stark difference from the shift toward graphics processing unit (GPU) based computing we saw in the early 2010s. Now, with such incredibly powerful processors available, software providers are optimizing their code to prioritize CPU, maximizing overall performance (at lower cost) than massively expensive GPU-driven workstations.

Grundstrom (Supermicro): There has been a definite shift in the enterprise since 2020 to centralize, consolidate and virtualize workstations for visual professionals. This approach also enables remote work to be more secure and efficient. The systems need to have enough cooling for the new and upcoming generations of CPUs and GPUs. These next generations of hardware will demand even more cooling than was previously required.

Herman (Lenovo): Customers need high-fidelity rendering for remote collaboration purposes as well as real-time management and customer review. These factors have caused a shift upward in terms of the need for higher performance GPUs, more memory, higher core counts and larger and faster storage capabilities such as M.2 drives.

DE: What workflow trends are affecting how customers buy workstations?

Mach (TotalCAE): We see more multiphysics in simulations, more realistic simulation of complex high-tech products and large design space exploration.

Covington (Velocity Micro): Virtual reality, augmented reality and extended reality (VR/AR/XR) in general have some professional applications that could take the design market in interesting places.

Bourgoyne (NVIDIA): Metaverse or VR/AR/XR-based workflows often require significant system performance to give customers a good user experience. These workflows require more powerful workstations with more powerful GPUs to deliver immersive experiences.

Grundstrom (Supermicro): NVIDIA Omniverse is often used in VR/AR/XR development. Omniverse Enterprise offers creators the ability to scale render workloads in parallel (up to 64 GPUs). This can significantly decrease electrical total transfer capacity on “digital world” VR projects and accommodate the most demanding simulation environments. To maintain low latencies for the user without unfortunate side effects, these configurations need to include the fastest available rendering performance.

Herman (Lenovo): The impact of game engine technology to the design space cannot be overstated. The need for higher fidelity rendering and putting these renders into motion is driving the need for game engines and technologies like VR for real-time collaboration and review.

AI is also emerging as a necessary technology going forward. The use of AI in generative design can help build a better quality and more efficient design faster. These elements drive the need for more powerful platforms with higher performing CPUs, more memory and storage, as well as GPUs with rendering and tensor core capabilities.

DE: Is there a change in buying patterns between workstations and high-performance computing clusters? Do you see tasks that were once reserved for HPC now moving to single-user workstations?

Mach (TotalCAE): [The] workstation will remain the day-to-day workhorse for smaller jobs, because today’s small problem is yesterday’s challenging problem. The most challenging simulations will still require HPC clusters and cloud.

Covington (Velocity Micro): There are definite changes. This goes back to the CPU innovations we’ve witnessed in recent years. Sixty-four physical cores on a single processor workstation with scalability up to 128 cores/256 threads has relegated the need for a GPU cluster to a few niche or specialized applications. We’re seeing most applications optimized for CPU rather than GPU computing now as a result and expect that trend to continue.

Bourgoyne (NVIDIA): With the growth of GPU acceleration in CAE applications from leading industry independent software vendors such as Ansys, Siemens and Altair, customers are now able to run larger structural, computational fluid dynamics (CFD) and discrete element modeling (DEM) simulations on workstations equipped with professional GPUs. These simulations were largely limited to CPU-based high-performance computing clusters in the past, which can severely limit access and availability. Higher memory GPUs can now run these simulations much faster and at a lower cost on workstations without the need to add more CPU cores.

Grundstrom (Supermicro): High-performance computing (HPC) clusters, or scalable parallel computing, will always be necessary for certain workloads for varying reasons. Some tasks can be executed on both servers and workstations. For example, engineering workstations can handle applications that may scale up to two sockets.

However, there are limitations on the networking speed for workstations, which limits the use of applications that can scale beyond a dual-processor configuration. Since workstations typically reside in an office environment, the fastest (and hottest) CPUs are not supported due to the fan speeds (and noise) that would be needed to cool the latest and future generations of CPUs and GPUs.

Herman (Lenovo): The pandemic has accelerated the shift to virtualized computing and the cloud. But this does not spell the end for the workstation client as we know it. We expect it to bring about a new computing paradigm, where hybrid computing is the norm. Workloads are able to move from client to cloud seamlessly, where the most complex tasks are tackled and where the highest performance resides, but rich clients are still needed at the endpoint to provide the highest fidelity experience for the tasks at the client level.

DE: Are you seeing new software or new workflows change how your customers use workstations?

Alex Herrera (Jon Peddie Research Workstation Report): NVIDIA Omniverse is opening the door to a new range of cloud-hosted and GPU-powered simulations. Not only does it offer real-time visual accuracy, Omniverse also offers machine learning capabilities to run at low-grain visual scale but intelligently upscale to fine-grain detail whenever needed. Siemens used Omniverse to create a digital twin of a wind farm. By running on an array of GPUs, they have turned days-long iterations into minutes. Siemens now believes the use of Omniverse to create a digital twin for the wind farm means they can deliver power for an additional 20,000 homes.

Bourgoyne (NVIDIA): A growing number of engineering applications across design, simulation and rendering or visualization is GPU accelerated. Such applications include Ansys Discovery and Fluent, Creo Simulation Live, MSC Apex, Onshape Simulation, SolidWorks and KeyShot Luxion, to name a few. This growth is driving the need for professional GPUs in workstations.

Covington (Velocity Micro): I think software for virtual reality environment design is probably the most relevant new thing in engineering software. It’s still niche, but there are certainly use cases.

Grundstrom (Supermicro): Immersive applications such as metaverse demand low-latency solutions. High-end video editing is growing. Combining engineering applications with, for instance, advertising with video is an area where applications may converge and need to be run on a high-end workstation.

Herman (Lenovo): Game engines have taken on increased importance. Photorealistic images and the ability to put them in motion is key to collaborative design efforts as well as team and management review.

DE: Will new CPUs running discrete graphics change the engineering workstation market?

Covington (Velocity Micro): Not in the short term. Intel’s new Arc graphics technology focus right now is competing primarily on the entry level and mid-tier, targeting consumers more than professional workloads. I do think there’s space for them in the market as an alternative to AMD and NVIDIA, but it’s going to take years and several product iterations before they’re able to take any significant market share, especially with professionals. Their decisions are driven so heavily by software support, an area where NVIDIA has an enormous lead.

Grundstrom (Supermicro): Intel discrete graphics could definitely change the market. The thinking behind OneAPI—a new programming standard for hardware acceleration— could potentially offer a streamlined development environment for visualized computing workloads.

Discrete graphics are an essential component of our workstations. As hardware is added to workstations, applications’ performance continuum is created. Applications can run entirely on CPUs and, when discrete graphics are present, will show performance improvement, but at a cost. On the other hand, there may be situations where a high-end discrete graphics card may not be needed, and a more mid-range solution may be ideal from a performance scenario.

Herman (Lenovo): Intel’s re-entry into the discrete graphics market creates more choice for customers. However, we view this move through a longer lens. With system-on-a-chip (SoC) designs and ARM emerging, the whole question of where compute should happen is coming into play. Over the long term, we see all the major players vectoring toward platforms in which CPUs and GPUs work more seamlessly together.

More Intel Coverage

More Jon Peddie Research Coverage

More Lenovo Coverage

More NVIDIA Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Randall S. Newton is principal analyst at Consilia Vektor, covering engineering technology. He has been part of the computer graphics industry in a variety of roles since 1985.

Follow DE