Fathom Digital Manufacturing Goes Public

The transaction is expected to enhance Fathom’s position in additive and traditional advanced manufacturing capabilities and accelerate Fathom’s investments in organic and inorganic growth opportunities.

July 16, 2021

Fathom Digital Manufacturing Corporation and Altimar Acquisition Corp. II, a special-purpose acquisition company sponsored by an affiliate of HPS Investment Partners, LLC, report that they have entered into a definitive business combination agreement pursuant to which Fathom and Altimar will combine, and after which Fathom will become a publicly traded company.

Upon completion of the transaction, the combined company expects to be listed on the New York Stock Exchange. Fathom is majority-owned by CORE Industrial Partners, a Chicago-based private equity firm focused exclusively on investing in North American manufacturing, industrial technology and services businesses.

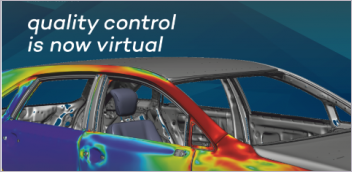

Headquartered in Hartland, WI, Fathom is a large service providers for rapid prototyping and on-demand additive and advanced traditional manufacturing services in North America with over 90 large-platform additive manufacturing machines and nearly 450,000 square feet of manufacturing capacity across twelve facilities nationwide, Fathom uses its software platform to blend in-house capabilities across plastic and metal additive manufacturing technologies, and advanced traditional manufacturing technologies that include CNC machining, sheet metal fabrication and injection molding.

Upon the closing of the proposed transaction, Fathom’s senior management will continue to serve in their current roles. Fathom will continue to be led by chief executive officer, Ryan Martin. Mark Frost and Rich Stump will continue as chief financial officer and chief commercial officer, respectively. Following the transaction, TJ Chung, senior partner at CORE, who has served on several public company boards, will continue to serve as chairman.

Fathom is a cash-generating business with $149 million in pro forma revenue in fiscal year 2020. The proceeds from this transaction will strengthen Fathom’s ability to continue investing in organic and inorganic growth opportunities as the market for its key service areas expands. The company will be guided through this growth by a management team with decades of combined manufacturing experience, along with a diverse board including former executives at manufacturing companies such as General Electric, 3M, Ingersoll Rand and Chrysler.

“With Industry 4.0 taking off, we believe Fathom is on the cusp of a significant growth opportunity, and we’re thrilled to be combining with Altimar as we make our public market debut and move into our next chapter,” says Ryan Martin, CEO of Fathom. “With our strong business profile and solid balance sheet, we see an opportunity to continue scaling up our capabilities in both on-demand additive and advanced traditional manufacturing.”

“We evaluated a wide range of potential targets, but it became clear to us in our search that Fathom’s ideal blend of speed, scalability, breadth and financial strength positions it to become a leading player in the modern manufacturing market,” says Tom Wasserman, chairman and CEO of Altimar Acquisition Corp. II. “As more companies realize the benefits of on-demand manufacturing, we believe Fathom’s multi-year head start has resulted in a high barrier to entry that few peers can penetrate.”

“When we first invested in Fathom, we knew the Company had a clear path for growth as one of the earliest adopters of additive manufacturing in a fragmented manufacturing space that was only just realizing the benefits of the Industry 4.0 on-demand business model,” says John May, managing partner of CORE Industrial Partners. “As we predicted, the market has evolved in Fathom’s favor, and the Company maintains a strong runway for expansion with a high degree of organic and acquisition growth potential.”

“We have full confidence in Ryan and his management team as they embark on this new chapter,” says Bob Nardelli, board member of Fathom. “Along with the partners at CORE, we have built a strong company, drawing from managers and board members with a diverse range of personal and professional backgrounds, that is ready to capitalize on the significant secular growth opportunity presented by Industry 4.0.”

Details of the Transaction

The transaction is valued at a pro forma enterprise value of $1.5 billion. The acquisition will be funded through a combination of ATMR’s cash in trust and an $80 million fully committed common stock PIPE at $10 per share.

The boards of directors of both Fathom and ATMR have unanimously approved the proposed transaction and it is expected to close later this year, subject to customary closing conditions, including a registration statement being declared effective by the Securities and Exchange Commission and approval of ATMR’s shareholders.

Additional information about the proposed transaction will be provided in a Current Report on Form 8-K to be filed by ATMR with the Securities and Exchange Commission and available here.

Advisors

J.P. Morgan Securities LLC and Stifel are serving as joint financial advisors and Winston & Strawn LLP is serving as legal counsel to Fathom. J.P. Morgan Securities LLC and Stifel are serving as joint placement agents and capital markets advisors, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to Altimar. Mayer Brown LLP is serving as legal counsel to the placement agents. In addition, BofA Securities, Needham & Company, LLC and Craig-Hallum Capital Group LLC are acting as capital markets advisors to Altimar.

Sources: Press materials received from the company and additional information gleaned from the company’s website.

More FATHOM Coverage

Subscribe to our FREE magazine, FREE email newsletters or both!

About the Author

DE’s editors contribute news and new product announcements to Digital Engineering.

Press releases may be sent to them via DE-Editors@digitaleng.news.